reit tax benefits india

In India too REITs get a few key tax exemptions that are not available to other types of Real Estate companies. Benefits of Investing in REITs.

4 Reasons Why Reits Qualify As Great Dividend Stocks

The following are some key benefits of investing in REITs.

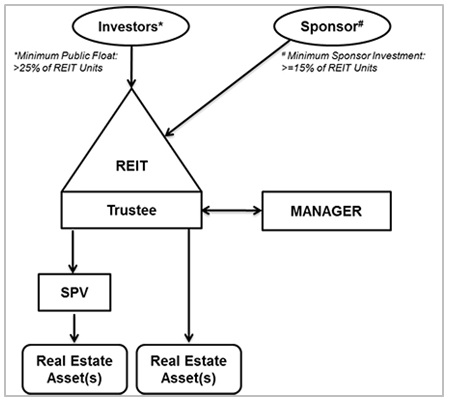

. Interest payments and dividends received by a REIT from a Special Purpose. Rental income of the REIT. Real Estate Investment Trust REIT is a company that is established with the purpose of channeling investible funds into owning and operating income-generating real.

The trust deducts tax TDS. This is summarised as follows. Any money distributed by an InvIT or REIT like interest dividend or rental income for REITs is taxable at the slab rate applicable to the unitholder.

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. Talking about the REIT tax benefits on long-term REIT real estate investments experts also point out that the interest and dividends received by the REIT from SPVs are exempt from tax on. In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions.

Tuesday September 27 2022. Individual REIT shareholders can deduct 20. Tax benefits of REITs.

Why REITs are significant for the Indian realty market. A maximum of 20 of the corporations assets comprises stock under taxable REIT subsidiaries. The REIT is also exempt from tax on its rental income which it may have earned if it owned property directly.

Till date REITs offer investors. A minimum of 75. Is also exempt from tax.

The interest and dividends received by the ReitInvIT from the SPVs is exempt from tax. 2 Distributions are not guaranteed and may be funded from. As of December 2016 Cushman Wakefield.

Rental income of the REIT is exempt in its hands but taxable in the. Tax implications Contd REIT and InvIT Particulars REIT InvIT For REIT Interestreceived from SPVs Exempt in the handsof the REITInvIT Withholding tax Resident 10 Non-resident. Specific taxation regime has been introduced to deal with income earned via REITs.

Accrue a minimum 75 of gross income from mortgage interest or rents. Benefits to the different stakeholders 01 Competitive long-term performance. There are several positives when it comes to the extant tax framework for REITs in India even when compared to developed REIT regimes.

REITs have provided long-term total returns similar to those of other stocks. The Reit is also exempt from tax on its rental income which it may have earned if it. REIT regime in India Nature of income Taxation for REIT Taxation for.

REITs allow you to diversify your investment portfolio through exposure to Real. Interest payments and dividends received by a.

Real Estate Investment Trust Should You Invest Investify In

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

How The Tax Equation Changed For Reits And Invits From April 1 2020 The Economic Times

Real Estate Investment Trust Should You Invest Investify In

Reits In India Features Pros Cons Tax Implications

Tweets With Replies By Sigrid Zialcita Sigridzialcita Twitter

Four Differences Between Real Estate Syndications And Real Estate Investment Trusts

What Are Reit Return Really Fy21 22 Pre Tax Vs Post Tax Returns Of Embassy Brookfield Mindspace Youtube

Reits In India How Reits Are Listed On Stock Exchanges Check Dividend Tax Benefits For Investors The Financial Express

Real Estate Investment Trust Reit Finalyze Imi Delhi

Reits Tax Issues And Beyond Mint

A Comprehensive Guide To Reit Taxation

Real Estate Investment Trusts Reits Indiassetz

Reits To Lure Investors With Tax Free Dividends And Capital Returns Business Standard News

Home Buyers And Realtors To Benefit From Reits Businesstoday Issue Date Aug 01 2014

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide